Update: This offer is expired.

————————————-

You can signup for any credit card, via the links in the credit cards tab on the top of the site. You can click on the “Credit Cards By Issuing Bank” link to find credit cards by card issuer.

——————————–

For a limited time only, American Express has increased the signup bonus on the Starwood Preferred Guest Credit Cards from American Express to their highest ever of 35,000 Starpoints!

With this increased offer, on the consumer card, you will receive 35,000 bonus points after you spend just $3,000 within the first 3 months of card opening.

For the business version of this card, you will receive 35,000 bonus points after you spend $5,000 within the first 3 months of card opening.

– Note that American Express now limits their signup bonuses, to once per lifetime per card, on both their consumer credit cards and business credit cards. That means, if you have previously had the consumer version of this particular card and not the business version, you won’t get a signup bonus when reapplying for the consumer version, though you will get a signup bonus if you apply for the business credit card. If in the past you had both the consumer and business versions of this card, you cannot get the bonus again.

- Our highest Starpoints offer ever. Get 35,000 bonus Starpoints! Offer ends 3/30/2016.

- No Foreign Transaction Fees on international purchases.

- Receive free in-room, premium internet access. Booking requirements apply.

- Enjoy complimentary, unlimited Boingo Wi-Fi on up to four devices at more than 1,000,000 Boingo hotspots worldwide. Enrollment required.

- Get free nights at over 1,200 hotels and resorts in nearly 100 countries with no blackout dates. Some hotels may have mandatory service and resort charges.

- $0 introductory annual fee for the first year, then $95.

- Terms and limitations apply.

With the SPG credit card, you’ll get 2 stays/5 nights towards Starwood elite status. If you have both the consumer card and the business card you’ll get 4/10 nights towards elite status.

With the business version of this card, you also get free access to Sheraton Club Lounges at any Sheraton with a lounge, and you’ll also earn cash back at select merchants with OPEN savings.

Besides for the increased signup bonuses, these cards will also of course get the awesome American Express benefits Including: Return Protection, Purchase Protection, Extended Warranty, Dispute Resolution and more. These American Express protections are second to none in the credit card industry.

You can get up to 99 free additional user cards, so you can take more advantage of Amex’s promo’s, such as Small Business Saturday, Amex Sync offers and more.

————-

Starwood Starpoints: (Note – Marriott Hotels has acquired Starwood Resorts and Hotels, so changes will most likely be coming at some point, though as of now there is no knowing when and what the new program will look like.)

Starpoints are from the most valuable and flexible from all the different points out there.

Here’s what they can be used for;

1. FREE Hotel Stays: SPG points can be redeemed for hotel stays at over 1,700 hotel properties worldwide. Starwood has great award availability with no blackout dates. If there is a room available you will get it.The Starwood hotel chain includes Westin, St. Regis, Sheraton, Design Hotels, Tribute Portfolio, Four Points by Sheraton, Le Meridien, Loft, W Hotels, The Luxury Collection and element hotels.

- Free nights start at just 2,000 points a night for weekend redemption’s or 3,000 points a night for weekday redemption’s at category 1 hotels.

- Category 2 hotels are 3,000 – 4,000 points a night.

- Category 3 hotels are 7,000 points a night.

- Category 4 hotels are 10,000 points a night.

- Category 5 hotels are 12,000-16,000 points a night.

- Category 6 hotels are 20k-25k points a night.

- Category 7 are 30k-35k points a night.

(If you are a gold member redemption’s will be less 250 points, as you’ll get a gift of 250 points, after you complete your stay).

On award bookings of 5 consecutive nights, you’ll get the 5th night free.

2. Cash and Points: Many times when redeeming for free nights, there is also a Cash & Points redemption option. This option allows you to use a smaller amount of points with a cash (in USD) outlay. Since the Cash & Points is always priced in USD, this can also save you a bundle in Europe where everything is normally priced in Euro/Pound.

3. Airline Transfers: The SPG points can also transferred to over 30 different airlines most at a 1:1 ratio, additionally when transferring to many airlines, you will receive a 5,000 mile bonus when you transfer 20,000 points in one shot.

Below is a list of airline transfer partners and the transfer ratio;

- Aeromexico Club Prmiere 1:1

- Aeroplan/Air Canada 1:1

- Air Berlin 1:1

- Air China Companion 1:1

- Air New Zealand & Air Points 65:1

- Alaska Airlines Mileage Plan 1:1

- Alitalia MilleMiglia 1:1

- All Nippon Airways (ANA) Mileage Club 1:1

- American Airlines AAdvantage 1:1

- Asia Miles 1:1

- Asiana Airlines 1:1

- British Airways Executive Club 1:1

- China Eastern Airlines 1:1

- China Southern Airlines 1:1

- Delta Air Lines SkyMiles 1:1

- Etihad 1:1

- Emirates Skywards 1:1

- Flying Blue 1:1

- Gol Smiles 2:1

- Hainan Airlines 1:1

- Hawaiian Airlines 1:1

- Japan Airlines (JAL) Mileage Bank 1:1

- Jet Airways 1:1

- Korean Air 1:1

- LAN LANPASS 1:1.5

- Miles and More 1:1

- Qatar Airways 1:1

- Saudi Arabian Airlines Alfursan 1:1

- Singapore Airlines KrisFlyer 1:1

- Thai Airways International Royal Orchid Plus 1:1

- United Mileage Plus 2:1

- Velocity Frequent Flyer 1:1

- Virgin Atlantic Flying Club 1:1

5. SPG Flights: Generally not the best redemption, but Starwood lets you use points for 1 cent each towards booking revenue airline tickets (meaning you get the miles and elite status for the flights) on over 350 airlines.

6. Gift Cards: You can also redeem your starpoints for gift cards at a 1 cent per point ratio, if you so wish.

you spend $1,000 on purchases within the first 90 days of account opening.

you spend $1,000 on purchases within the first 90 days of account opening. with the Costco Anywhere Visa Card by Citi. This new credit card, is available both in a personal version and a business version and is available only for Costco members.

with the Costco Anywhere Visa Card by Citi. This new credit card, is available both in a personal version and a business version and is available only for Costco members.

properties! The other Hilton credit card that Citi offers, is the Citi HHonors Visa Signature Card card which only has a 40,000 point signup bonus.

properties! The other Hilton credit card that Citi offers, is the Citi HHonors Visa Signature Card card which only has a 40,000 point signup bonus.

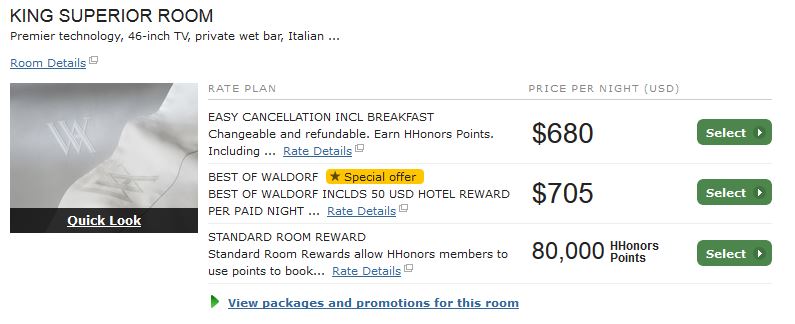

(Waldorf Astoria Jerusalem sample weekend rate, mid June - FREE with just

one of your night certificates!)

(Waldorf Astoria Jerusalem sample weekend rate, mid June - FREE with just

one of your night certificates!)

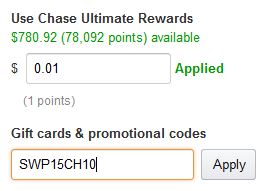

is the IHG Rewards Club Select Credit Card from Chase. The sign-up bonus on this credit card is 70,000 bonus points after you spend just $1,000 in the first 3 months of account opening.

is the IHG Rewards Club Select Credit Card from Chase. The sign-up bonus on this credit card is 70,000 bonus points after you spend just $1,000 in the first 3 months of account opening.

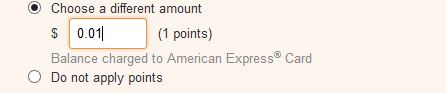

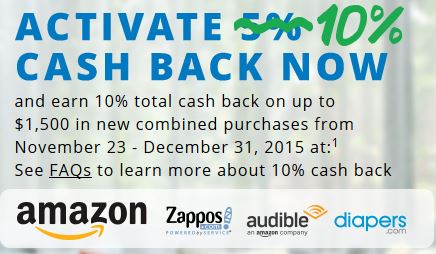

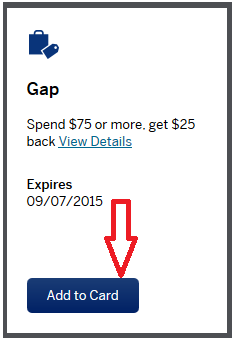

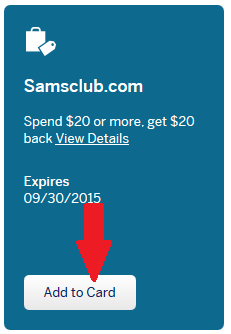

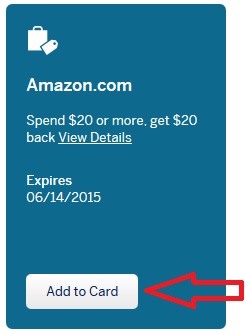

is valid through June 6, 2015. Though these offers do have a cap and will most likely fill up before then, so as soon as you can you should check to see if you have this targeted offer in your account.

is valid through June 6, 2015. Though these offers do have a cap and will most likely fill up before then, so as soon as you can you should check to see if you have this targeted offer in your account.

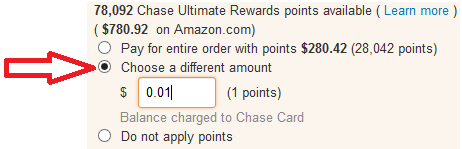

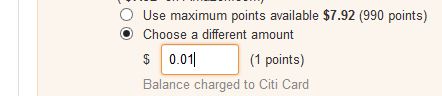

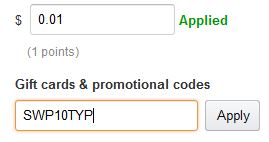

n Express Membership reward points. The great thing is that you can use as little as just 1 point to trigger the $20 promo!

n Express Membership reward points. The great thing is that you can use as little as just 1 point to trigger the $20 promo!