Update: This offer is expired.

—————————-

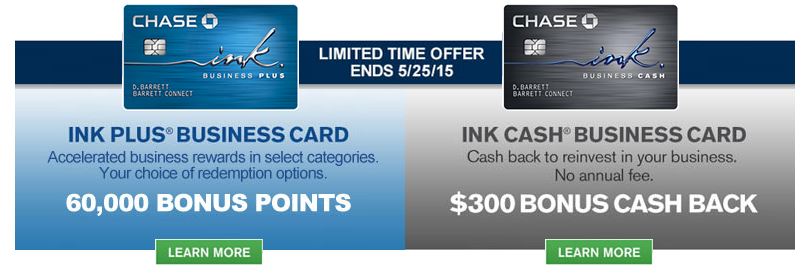

For a limited time, Chase bank has increased the bonus on the Chase Ink Plus credit card, to 60,000 bonus points!!

To get the 60,000 point bonus offer, you will need to spend $5,000 on the card within the first 3 months of account opening. After your initial $5,000 spend, you will have between 65,000 points or as much as 85,000 points, depending on where you do your spending.

Points earning on the Chase Ink Plus credit card:

- Earn 5X points per $1 on the first $50,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year

- Earn 2X points per $1 on the first $50,000 spent in combined purchases at gas stations and hotel accommodations when purchased directly with the hotel each account anniversary year

- Earn 1 point per $1 on all other purchases—with no limit to the amount you can earn

You can maximize your points earning by purchasing gift cards such as to Amazon, Marshalls or other merchants on the “Ink Plus” card, at office supply stores like Staples, OfficeMax etc;, where you earn 5x points on purchases. With this method, you will essentially be earning 5x points when shopping on Amazon or at Marshalls etc;!

There are no foreign transaction fees with this card.

There is a $95 annual fee for this card, which is not waived. Though 60,000 bonus points is more than worth it.

Redeeming Points: Besides for cash-back, the Chase Ink points can also be redeemed for travel through Chase Ultimate Rewards or can be transferred on a 1:1 point ratio to Airline and Hotel loyalty programs where you can redeem your points for free flights or for free nights at hotels worldwide!

The Chase ink point transfer partners are: United Airlines, Virgin Atlantic, British Airways, Korean Air, Singapore Airlines, Southwest Airlines, Amtrak, Ritz-Carlton, Priority Club, Ritz Carlton, Marriott Rewards and Hyatt.

The Ink Plus credit card is a Business card, but you DO NOT NEED to be incorporated or have a business in the traditional sense to apply for a business credit card. If for instance you sell on ebay, or even if you have any other side business (and you want to keep your expenses separate), you are eligible to apply for a business credit card. When filling out the business credit card application, choose “Sole Proprietor” as the type of business and fill in your name as your business name. For the Tax I.D. you will write your Social Security Number.

You do not need to have any revenue yet from your business to be eligible for a business credit card.

Additionally, With a business credit card, your balance is not reported on your personal credit report. That’s a nice perk, being that a whopping 30% of your credit report is made up of your credit utilization.